cash tax refund check with two names

When the Internal Revenue Service issues a tax refund to joint taxpayers in the form of a check you will receive the check with both of your names printed on it. The rules are generally the same across most of the top US.

The Most Common Question We Get Asked Is Why Is The Vignelli Center At Rochester Institute Of Tech Vignelli Massimo Vignelli Rochester Institute Of Technology

I received my US federal tax return earlier this month.

. Splitting your refund is easy and can be done electronically if you use IRS Free File or other tax software. Most banks will allow this if both parties sign the check. Fees for checks between 200001 and 5000 start at 550 with Shoppers Card.

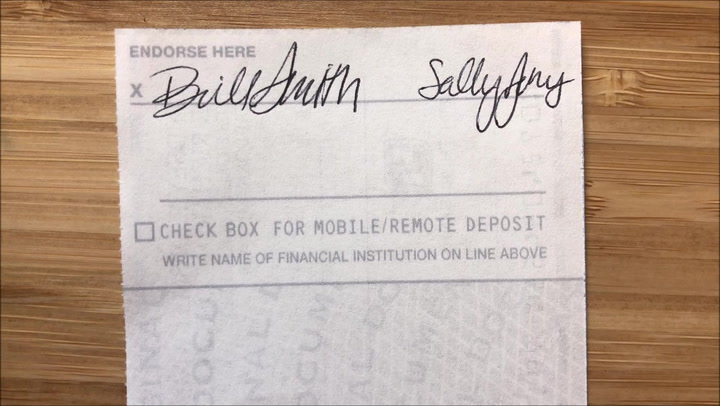

For example the Walmart check cashing policy in Texas and elsewhere in the US. Because banks have strict regulations for cashing checks made out to two parties youll have a lesson in togetherness as you cash a joint tax refund. If you receive such a check you can tell how to deposit it at Advantis by noting how both names are written in the Payable To line.

Form 8888 is not required if you want IRS to direct deposit your refund into. Up to 2 cash back Check cashing fees start at 3 with Shoppers Card for checks up to 2000. If you are unavailable to sign its possible for your account co-owner to deposit the check into the account with just one signature and withdraw cash at an ATM.

The amount varies by bank but is typically less than 10. How can I cash a jointly tax refund check with both spouse names on it if one spouse live in overseas. Imposes a 4 fee on all transactions up to 1000 and 8 for transactions above that amount.

Get Help from a Relative. Check your local Money Services. If a check with two names says and on the pay to the order of line then everyone has to endorse the check.

If you dont have one you can cash the check at any bank. Basically when you deposit a check written to multiple payees all payees must. Now that tax season has officially begun some Advantis members may receive tax refund checks from the IRS made out to two names.

If the issuer of the check lists the names with the word or in between them or the names are listed separately one to each line then either person may cash the check without the others permission. You can sign a federal tax refund check over to a family member to be cashed or deposited into his account. The answer was yes they will cash a check with 2 names with only 1 signature.

MY NAME MOTHERS NAME 111 EXAMPLE ROAD AUSTIN TX. By state law the executor or administrator of a deceased persons estate can endorse checks including checks on principal or interest tax refunds or payments for goods and services so it makes sense to bring the check to the. Certain circumstances may make you have someone else cash your refund check for example when an individual record isnt right now accessible or when you have guaranteed the check as installment or a blessing.

When I first looked at the check I noticed it had a symbol followed by my mothers name on the line below the one with my name. If the check lists the names with the word and or a sign in between the names then both parties must endorse sign the back of the check to cash the check. If you have a bank account your bank will cash your refund check without charging a fee.

Depending on the banks policy it might require the check to clear before your relative can access the funds. If the names are separated by the words or or andor or by a comma or if each name is on a separate line. If the word or exist between the two names then it is likely they would cash or deposit it for you.

This is because it was intended for either recipient. If you have a joint account the co-owner can cash your refund check on your behalf. To cash a check with 2 names separated by and contact your bank or financial institution since every bank has its own rules about this.

Policies vary depending on the retailer but you will pay a fee. You wont be able to cash it however you can deposit it into your own account it does not have to be a joint account as long as one of your names on that. Now that tax season has officially begun some Advantis members may receive tax refund checks from the IRS made out to two names.

Because banks have strict regulations for cashing checks made out to two parties youll have a lesson in togetherness as you cash a joint tax refund. If you file a paper return use Form 8888 Allocation of Refund Including Savings Bond Purchases to split your refund among two or three different accounts. If the word and appears between the two names it is likely they will not allow you to deposit or cash it.

When the Internal Revenue Service issues a tax refund to joint taxpayers in the form of a check you will receive the check with both of your names printed on it. You can also request that your refund direct deposit be split among up to three different accounts. Some will charge a small fee for the service because you are not a customer.

Youll need to sign the check over to your relative by endorsing the back and writing the words Pay. If you no longer have access to a copy of the check call the IRS toll-free at 800-829-1040 individual or 800-829-4933 business see telephone and local assistance for hours of operation and explain to the. Most of the year the limit on check cashing is 5000 but from January to April during prime tax refund.

Banks with a few additional requirements by some banks. This is because it was intended for both individuals. In such cases you can embrace the check to the individual similarly as you would with some other check so the individual can cash it.

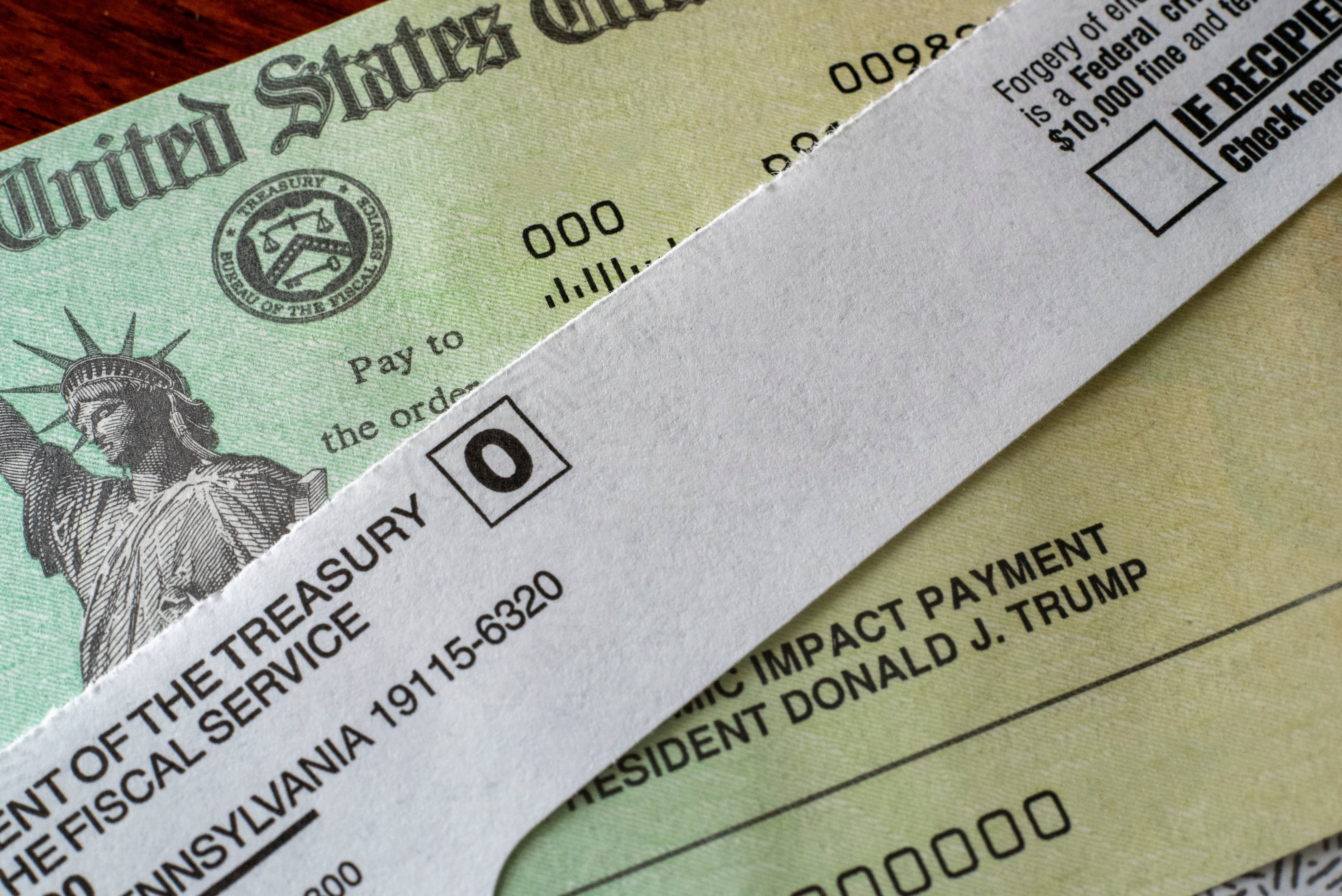

The location is based on the city possibly abbreviated on the bottom text line in front of the words TAX REFUND on your refund check. Also you could use the check to open an account which is. Fees limits vary by state.

This is useful to place money into checking savings and even an. Post by Deleted onJun 13 2013 at 805pm. If the names are separated by a comma or andor or nothing at all you can endorse and cash the check yourself.

6 Exceptions To Paying Tax On Forgiven Debt Creditcards Com Paying Taxes Compare Credit Cards Forgiveness

Are You Looking For A Great Credit Card That Pays You To Use It Check Out So Of The Amazing Cards Availab Personal Cards Mastercard Credit Card Travel Rewards

Don T Toss These 2 Important Stimulus And Child Tax Credit Letters From The Irs

What Is Partnership Agreement Template A Partnership Is A Business Formed With Two Or More People Each Indivi Contract Template Agreement General Partnership

Get Our Example Of Direct Deposit Payroll Authorization Form Payroll Legal Questions Being A Landlord

Direct Deposit Form Template Word Sample Direct Deposit Form 8 Download Free Documents In Form Example Letter Templates Templates

Tax Season Wild Guess Giveaway Fun With Tax Forms Can You Guess How Many Pieces Of Paper Are In This Jar For A Cha American Express Gift Card Jar Tax Forms

Tax Filing Season Kicks Off Here S How To Get A Faster Refund

Inflation Ruining Your Budget 3 Clever Ways To Save While Shopping And More In 2022 Child Tax Credit Irs Taxes Tax Refund

Irs Delays The Start Of The 2021 Tax Season To Feb 12 The Washington Post

Pin By Cindy Travers On Aving Checking Account Accounting Older

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Joint Check Agreement Form Within Joint Check Agreement Template 10 Professional Temp Email Template Business Business Plan Template Email Template Examples

What Is A Two Party Check Where Can You Cash It Mybanktracker

How A Second Checking Share Can Help You Budget In 2022 Budgeting Managing Your Money Financial Tips

How To Cash A Two Party Check Without The Other Person With One Signature Etc First Quarter Finance

Explore Our Image Of Deposit Form For Bill Of Sale Email Template Business Business Plan Template Email Template Examples

19 Ridiculously Useful Tips Every Blogger Should Know Blog Tips Blogging Advice Blog Income