nebraska vehicle tax calculator

Your purchase will be charged to your Nebraskagov subscriber account. If you are not a Nebraskagov subscriber sign up.

Dmv Fees By State Usa Manual Car Registration Calculator

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

. This service is intended for qualified business professional. View the Nebraska state fee estimator to verify your registration cost and use our DMV Override to adjust the calculator. The nebraska state sales and use tax rate is 55.

View Vehicle Details History Reports Tools More. You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code. Ad File Heavy Vehicle Use Tax Form for Vehicles Weighing over 55000 Pounds.

Motor vehicle sales tax collection information is compiled from monthly county treasurers reports. All data based on your calculation. Maximum Possible Sales Tax.

Maximum Local Sales Tax. Keller is the Nations Leader in Transportation Regulatory Compliance. Nebraska State Sales Tax.

Keller is the Nations Leader in Transportation Regulatory Compliance. Ad File Heavy Vehicle Use Tax Form for Vehicles Weighing over 55000 Pounds. 425 motor vehicle document fee.

The average effective property tax rate in nebraska is 161 which ranks among the 10 most burdensome states in the country when it comes to real estate taxes. For example lets say that you want. The calculator will show you the total sales tax amount as well as the county city.

17007 Burt Street in Omaha 4606 North 56th Street in Omaha no written or drive tests 4502 Maass Road in Bellevue and 500 West O Street. Sarpy County Courthouse Campus 1210 Golden Gate Drive Papillion NE 68046 402-593-2100 Sarpy County 1102 Building 1102 E. View Vehicle Details Reports Tools More.

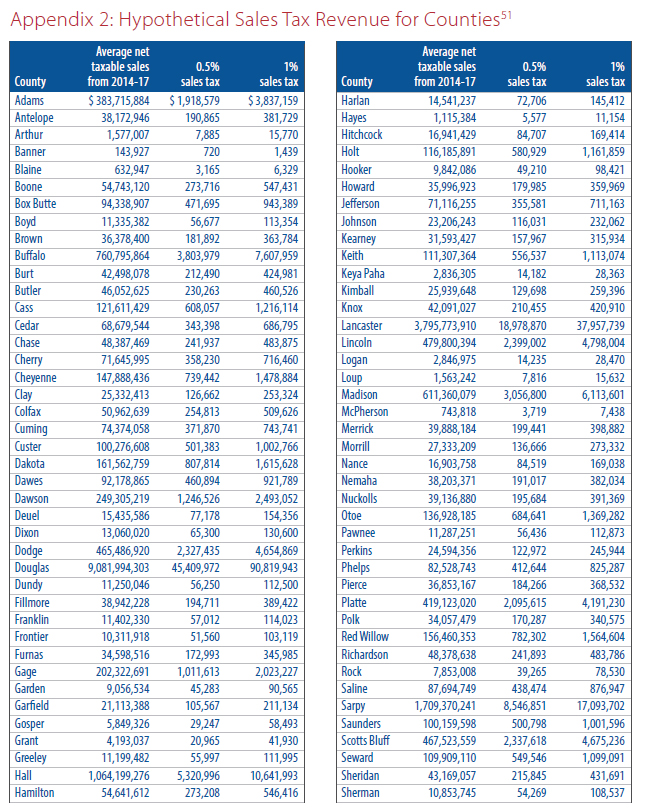

The statistics are grouped by county. Ad Find Your Motor Vehicle Centre Nebraska. 1st Street Papillion NE 68046.

The net price of 38250 equals the. In 2012 Nebraska cut income tax rates across the board and adjusted its tax brackets in an effort to make the system more equitable. In Nebraska the sales tax percentage is 55 meaning.

Average Local State Sales Tax. Once the msrp of the vehicle is established a base tax set in nebraska motor vehicle. Today Nebraskas income tax rates.

Nebraska vehicle tax calculator. You can calculate the sales tax in Nebraska by multiplying the final purchase price by 055. 2022 July 2022 and July 2021 10042022.

Vehicle Information required Motor Vehicle Tax calculations are based on the MSRP Manufacturers Suggested Retail Price of the vehicle. Sales tax is calculated using the percentage of the items value that must be paid in addition to the full price of the item. How to Calculate Nebraska Sales Tax on a Car.

Find Your Vehicle Info Online.

Vehicle Title Tax Insurance Registration Costs By State For 2021

Nebraska Income Tax Ne State Tax Calculator Community Tax

Most States Have Raised Gas Taxes In Recent Years Itep

Nebraska Sales Tax Small Business Guide Truic

Taxes And Spending In Nebraska

Nebraska Income Tax Ne State Tax Calculator Community Tax

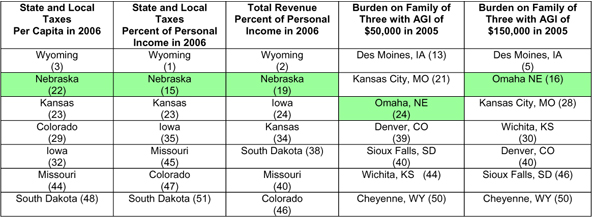

Taxes And Spending In Nebraska

Vehicle Title Tax Insurance Registration Costs By State For 2021

Taxes And Spending In Nebraska

Dmv Fees By State Usa Manual Car Registration Calculator

2021 Ne Dor Form 6 Fill Online Printable Fillable Blank Pdffiller

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

Explanation Of Registration Fees And Taxes Douglas County Treasurer

How The Nebraska Wheel Tax Works Woodhouse Nissan

Nebraska Income Tax Calculator Smartasset

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan